Client

AA Ireland

Industry

Insurance

Project

AA Common Customer File System (CCF), Management Reporting Suite and Travel Policy Administration System (TPAS)

Challenge

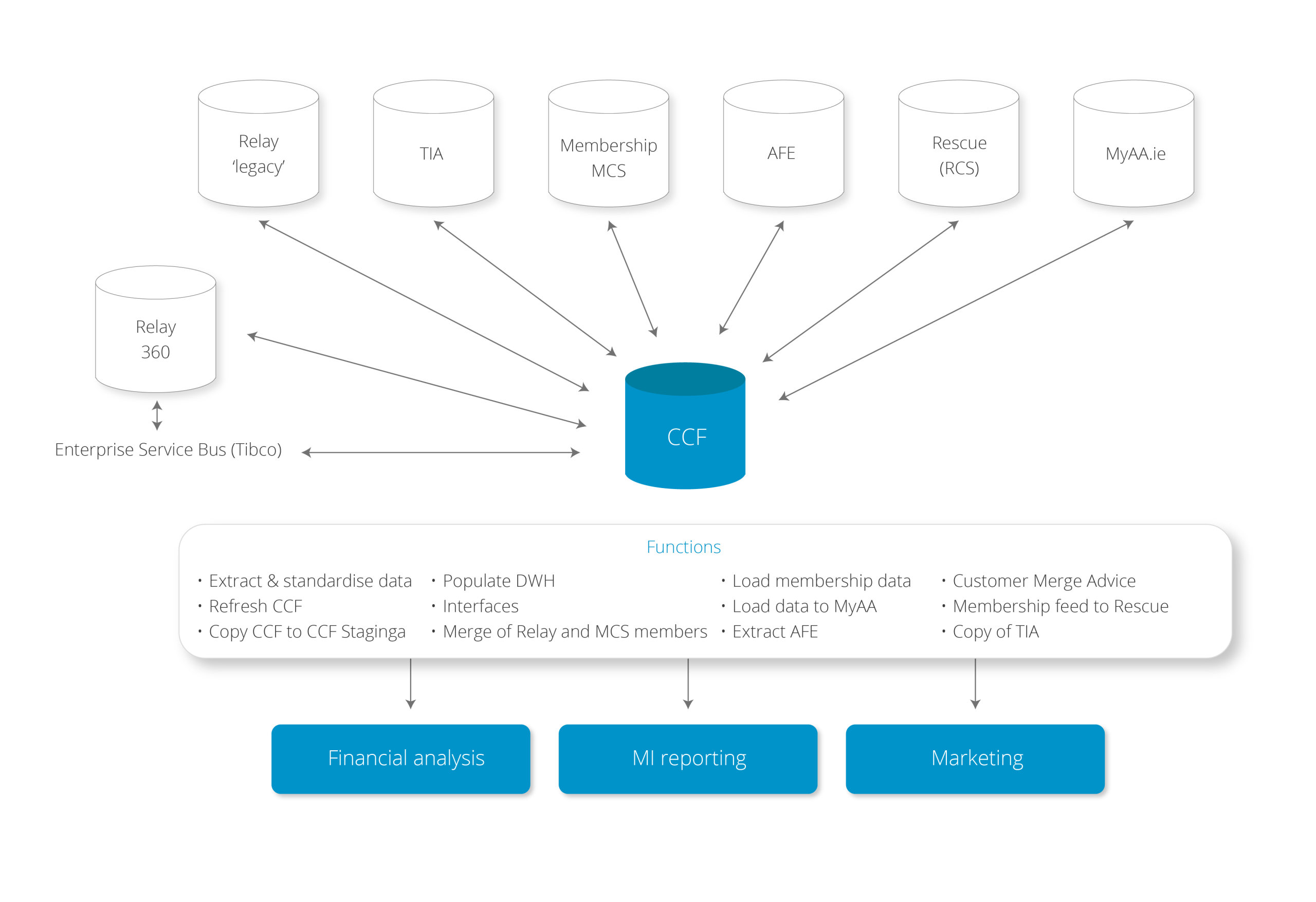

The AA had multiple independent transaction systems within its organisation for motor, home and roadside insurance etc. These systems detailed the origin and transactional history of each of the AA’s quarter of a million customers. Each customer had a record of their own within independent systems, leading to the creation of numerous records for the same customer. Dataconversion was tasked with developing a solution which would identify and match common customers and their different product holdings which were stored in different database systems.

This Single Version of the Customer (SVC) or Common Customer File (CCF) would then be used as the basis for all management reporting, financial analysis, marketing and sales efforts throughout the AA.

In addition, the AA wanted a scalable, enterprise-level solution to sell Travel Insurance to their customers. Dataconversion developed a Travel Policy Administration System. This needed to be a multi-product insurance policy administration system integrated with a payment gateway, and with a custom ETL process which fed into the newly developed CCF.

Nature & scope

Dataconversion was tasked with developing and supporting a custom database and ETL solution process to identify and match common customers and collate their different product holdings across several policy administration systems, along with the build of a multi-product insurance policy administration system. All transaction and customer data needed to be warehoused to facilitate MI and analytics processes.

This project included the following objectives:

- Consolidate all customers from different systems in the AA

- Streamline the input of data (desktop & tablet)

- Address the persistent data quality issues by having clean and standardised customer data

- Match customers accurately to de-dupe them and update changes from disparate systems

- Create a single version of the truth for business use including MI and analytics

This was a bespoke software development project which was core to The AA’s business goal of integrating and having a strategic MI overview of multiple customer touch points within the business.

The software solution Dataconversion developed for The AA needed to contribute to streamlining and automating the AA business processes, ultimately reducing costs, and improving the service The AA can offer to its customers.

Finally, the solution provided to The AA needed to work in tandem with their existing infrastructure while starting to future proof their service provision.

Dataconversion’s role and responsibilities

Dataconversion were responsible for the design, development and implementation of both the multi product insurance policy administration system and of the custom ETL process and CCF solution. This involved the following general tasks:

- Requirement gathering

- Solution design

- Project planning and internal and external stakeholder management

- Testing

- Deployment

- Hypercare and ongoing support

Dataconversion designed, developed and deployed the solution, a system involving the following:

- A ruleset to identify and match the common customer records held in the many transaction systems in a highly regulated industry.

- An ETL process to connect to and gather customer records from all of the transaction systems.

- Automation of business tasks / processes.

- A robust and resilient overnight process to synch all data, and error handling

- A software process to iterate through, identify and merge customer records into a single record for reuse.

- A software process to warehouse these merged customer records along with their various product holdings.

- A system architecture to allow the data warehousing system to connect to the various transaction systems.

- Ability to scale to support more systems / users

- Robust access controls for access to customer data, based on GDPR / need-to-know rules

- Through the development and use of a common customer API, enable the transaction systems to seek and reuse the existing customer records held in other internal and external transaction systems

- Development of API gateways for external integrations (e.g. payment gateway providers) and working with 3rd party vendors to ensure seamless integrations

- Merge data in the common customer file database, rather than recreating a new customer record time and again

- Build and deployment of the entire cloud-based solution within a strict 4-month period (due to pre-existing data centre constraints)

- Highly customised reporting suite with access controls for various management levels.

Summary

The resulting transaction and common customer systems now form, through the implementation of the warehousing process, the basis for all sales and marketing activity across the organisation including cross selling, up selling, as well as management reporting. It also plays a crucial role in the construction of customer analysis models, for example renewal propensity, etc.

The common customer system, designed and developed by Dataconversion, interacts with all online and internal transaction journeys within the AA through the use of an extensive suite of custom APIs, also designed and developed by Dataconversion.

Want to find out more about our services?

Simply call us on +353 1 8041298 or pop your business email in the field below, hit ‘enter’ and we’ll be in touch!

Want to find out more about our services?

Simply call us on +35318041298 or pop your business email in the field below, hit ‘enter’ and we’ll be in touch!